Meezan Bank Account Opening: With the rapid advancement of technology, the financial industry has undergone significant transformations, revolutionizing the way we manage our money.

Meezan Bank, a renowned Islamic bank in Pakistan, has embraced this digital revolution by introducing a convenient and user-friendly online account opening service.

Whether you are a tech-savvy professional or a busy entrepreneur, Meezan Bank’s account opening online facility ensures a hassle-free banking experience from the comfort of your own home or office.

In this article, we will explore the charges, requirements, limits, and a step-by-step guide on Meezan Bank account opening online. So, let’s start our guide!

Meezan Bank Account Opening: Riba-free Meezan Asaan Current Account Benefits:

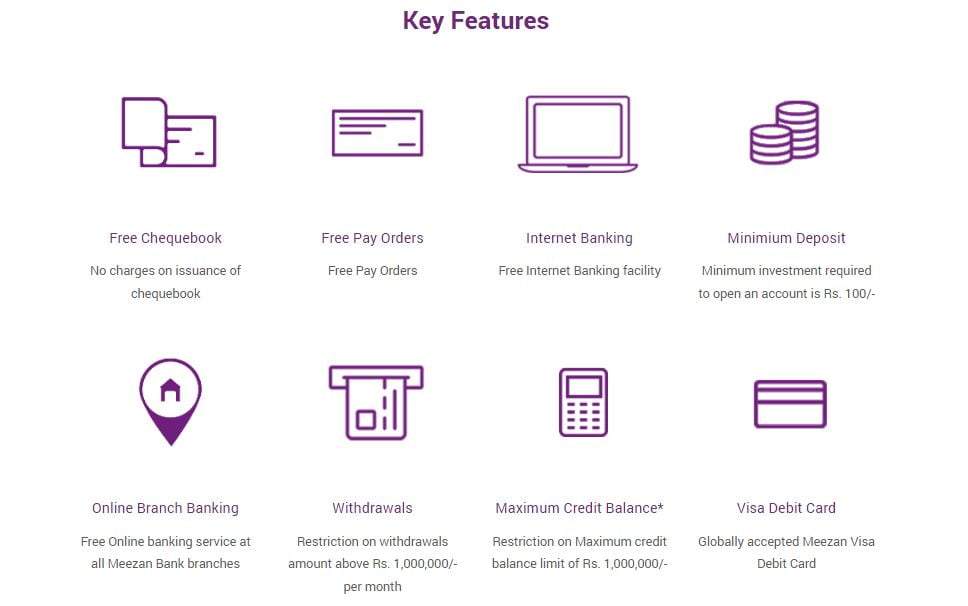

| Features: | Details |

|---|---|

| Free Chequebook: | No charges for issuing a checkbook. |

| Free Pay Orders: | Pay orders are issued free of charge. |

| Internet Banking: | Access online banking services for free. |

| Minimum Deposit: | Only Rs. 100 required to open an account. |

| Online Branch Banking: | Enjoy free online banking at all Meezan Bank branches. |

| Withdrawal Limit: | Withdraw up to Rs. 1,000,000 per month. |

| Maximum Credit Balance: | Maximum credit balance limit of Rs. 1,000,000. |

| Visa Debit Card: | Use the globally accepted Meezan Visa Debit Card for transactions. |

Meezan Bank Account Opening: Riba-free Meezan Asaan Current Account Opening Requirements:

Meezan Bank Account Opening: Step-by-Step Process of Meezan Bank Current Account Opening Online:

Meezan Bank Account Opening: Step-by-Step Process of Meezan Bank Current Account Opening by Visiting the Nearest Branch:

Meezan Bank Account Opening: After accessing the Meezan Bank official website for Internet banking registration at https://ebanking.meezanbank.com/AmbitRetailFrontEnd/mblOnlineRegistration.

Provide the initial information CNIC/NICOP, NTN, or passport number, and then follow the next steps to complete the online banking registration by providing the following information step-wise.

Meezan Bank account opening has varying charges depending on the type of account.

For example, Meezan Bank Asaan Account opening is free of cost, you just need to deposit PKR 100 as an initial deposit

To obtain an ATM card for your Meezan Bank Asaan Account, you can inquire about the process and associated charges at your nearest Meezan Bank branch. There are no charges for an ATM card for my Meezan Bank Asaan Account.

Meezan Bank provides online banking services that allow customers to conveniently check their account balances.

You can access your account through the Meezan Bank Account Opening official app or their Internet banking portal to view your account balance and transaction history.

Meezan Bank Account Opening requirements may include providing valid identification documents such as CNIC, SNIC, NICOP, proof of address, and proof of income/source of funds.

Yes, Meezan Bank provides online access to account statements. You can view and download your account statement through the bank’s official app or Internet banking portal.

Meezan Bank Account Opening Online allows you to conveniently track your transactions and monitor your account activity.

Meezan Bank Account Opening: To open a Meezan Bank account, you have two options: online account opening or visiting the nearest branch.

For Meezan Bank Account Opening online, you can download the Meezan Bank Official App and follow the step-by-step process provided.

Alternatively, you can visit the nearest Meezan Bank branch for Meezan Bank Account Opening, obtain an Account Opening Form (AOF), fill it out, and submit it along with the required documents.

The documents typically required for Meezan Bank account opening include a valid identification document (such as CNIC, SNIC, NICOP), proof of address, source of income details (such as salary slips or business documents), and any additional documents specified by the bank.

Meezan Bank Account Opening imposes certain withdrawal limits to ensure security and compliance. While there are unlimited withdrawals allowed, there may be restrictions on the withdrawal amount above PKR 1,000,000 per month.

It is advisable to refer to the specific terms and conditions of your chosen Meezan Bank account or contact the bank directly for detailed information on withdrawal limits.

Yes, Meezan Bank Account Opening is known for its Islamic banking principles and offers Riba-free (interest-free) banking solutions.

This appeals to individuals who prefer banking services that comply with Islamic financial principles.

Meezan Bank Account Opening has a minimum deposit requirement for the account. As per the information provided, the minimum deposit for an Asaan Current Account is Rs. 100/-.

However, it’s important to note that different Meezan Bank Account Opening types may have different minimum deposit requirements.

Yes, Meezan Bank Account Opening online allows Pakistani citizens who are minors to open an account. In such cases, a valid Form-B or Juvenile Card is required as an identification document.

Additional requirements or conditions may apply, so it is recommended to contact Meezan Bank directly for detailed information on Meezan Bank Account Opening as a minor.

The Meezan Bank Account Opening offers several benefits, including a free:

Chequebook, free pay orders, free internet banking, free online banking, a globally accepted Meezan Visa Debit Card, unlimited withdrawals (with a restriction on amounts above PKR 1,000,000 per month), and a maximum credit balance limit of PKR 1,000,000.

Meezan Bank typically activates and makes the account operative within one working day after completing the account opening process.

Once the account is activated, you will receive the necessary details and instructions to access and manage your account.

It’s important to note that the activation timeframe may vary and can be influenced by various factors, so it’s advisable to contact Meezan Bank Account Opening officials for the most accurate information regarding account activation timelines.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

As a seasoned banker, financial expert, and prolific finance writer, I bring a wealth of experience and insight to the table. With a passion for demystifying complex financial concepts and empowering individuals with practical knowledge, my work aims to simplify the world of finance for everyone. Trust my expertise to navigate the intricacies of banking and financial matters with clarity and precision..